Understanding interest calculations, and charges on payables finance facilities

Interest is calculated daily, capitalised monthly, and collected via direct debit intra-term.

Your interest payments are determined by the details outlined in your facility agreement or deed. Please refer there for detailed information.

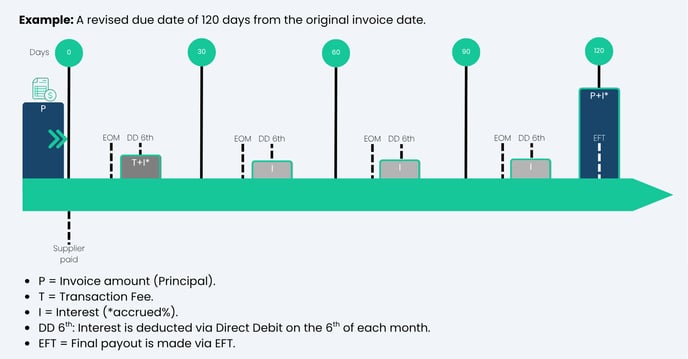

Generally, on all payables finance facilities (Trade Finance or Supply Chain Finance), interest is charged at a daily rate and capitalised monthly, then paid via direct debit from your nominated bank account on the 6th of the following month.

Should the 6th happen to fall on a weekend or holiday, the deduction will occur on the next business day.

For instance, if Fifo Capital funded a supplier invoice in June, the interest (including both the Transaction Fee and any interest accrued during that month) will be directly debited from your account on 6 July. Each month thereafter, within your extended payment term (120 days in the example above), will be deducted via direct debit.

When the transaction or invoice reaches the Revised Due Date, you'll need to make the final payment of Principal and Interest accrued directly via Electronic Funds Transfer (EFT). This is done manually into the Fifo Capital bank account specified in Fifopay.

If you have any questions or need assistance, feel free to reach out to our friendly operational team members who are always here to help!